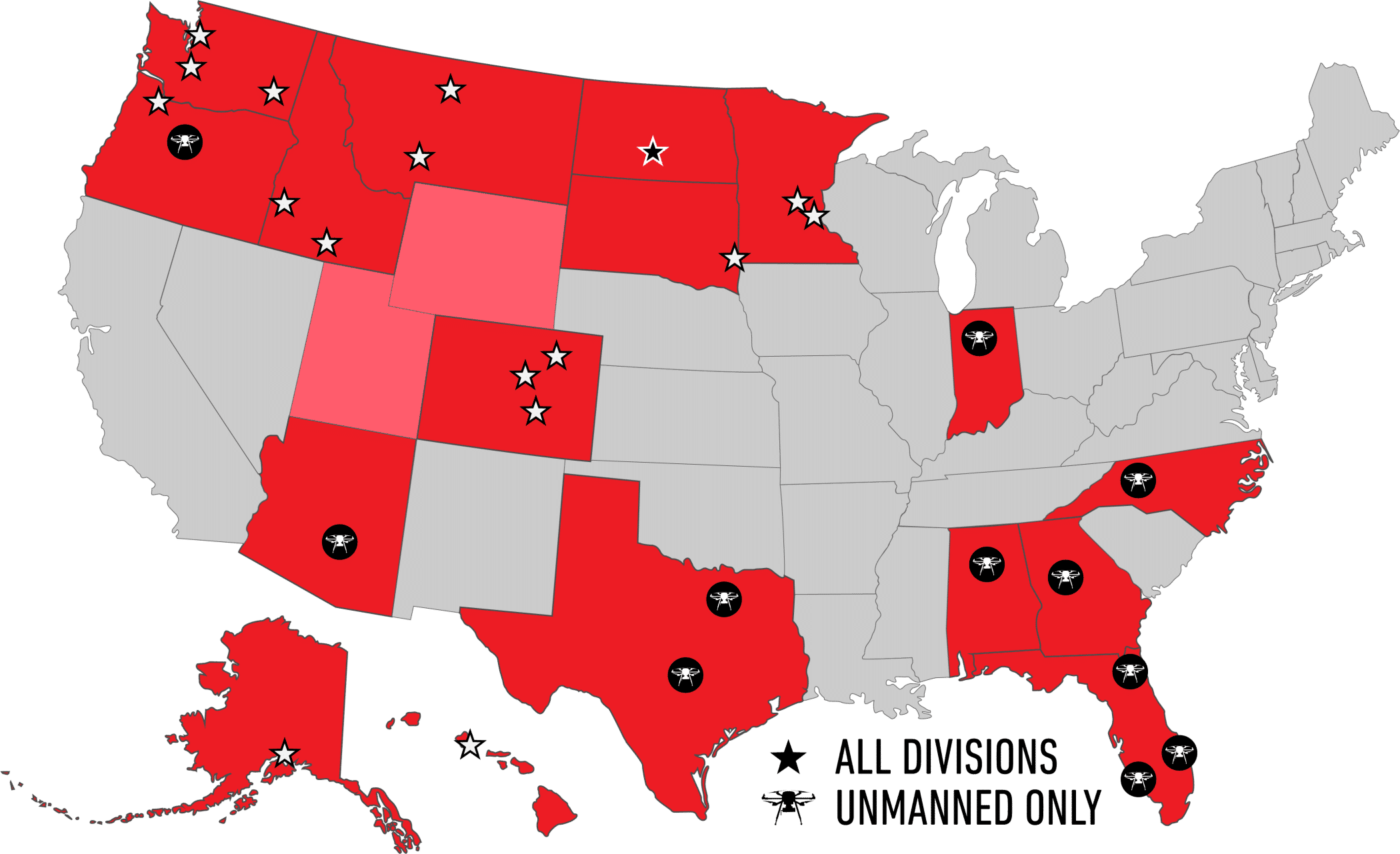

Bismarck, ND (Corporate – HQ)

FRONTIER CERTIFIED SERVICE CENTER / RETAIL LOCATION

Open: Monday – Friday

8:00 AM – 5:00 PM

(Central Time Zone)

Corporate Office:

Toll-Free:

Survey Technical Support:

Mapping Technical Support:

Address:

Frontier Precision1713 Burlington Drive

Bismarck, ND 58504

Staff:

- Dennis Kemmesat

President / Chief Executive Officer - Kevin Hellman

Chief Financial Officer - Nathan Kupfer

Geospatial Senior Account Manager - Danielle Moe

Geospatial Sales / Support - Tyler Bohl, PLS

Applied Geospatial Engineer - Luke Odegard

Controller - Sherrisa Lam

Staff Accountant - Paula Kinnischtzke

Accounts Receivable / Administrative Support - Lacey Hanson

Accounts Receivable Specialist - Jenn Heinrich

Creative Director - Tovah Danielson

Graphic Designer - Morgan Hartze

Graphic Designer - Melissa Marquardt

Marketing Coordinator - Jake Thomas

Human Resources Manager - Jenna Flemmer

Human Resources Assistant - Kyle Rosenau

IT Customer Service Specialist - Chris Carr

Warehouse Manager - Dalton Kemmesat

Warehouse Operations - Ben Schafer

Purchasing Manager - Derek Vetsch

Purchasing - Noah Bennett

Service Technician

Staff:

- Collin Kemmesat

Regional Sales Manager – Midwest – UAS - Paul Kline

Applied Geospatial Engineer – UAS

Staff:

-

Bryer Kaczynski

Service (Ag Drones)